Ksolves India Limited is a Software Development Company, who working on cutting-edge technologies like Big Data, Machine Learning, Salesforce®, Odoo, etc. With a team of 450+ developers and architects, Company are consistently delivering innovative and customized software solutions that drive growth, efficiency, and success for their client’s businesses.

2012 - Mr. Ratan Srivastava laid the foundation for Ksolves India Limited, with a small office in Indirapuram. The seed was sown with the name of Kartik Solution.

2014 - The seed sown with the name of Kartik Solution was transformed into Ksolves India Pvt. Ltd. This year marks the evolution of Ksolves.

Subsidiaries

The company has acquired shares equivalent to 100% (100 percent) of the total capital of Ksolves LLC, USA. The effective acquisition had zero debt as on effective date. Ksolves LLC, USA has become the fully owned subsidiary of the Ksolves India Limited with effect from June 11, 2021.

Partnerships

The company has entered into strategic partnerships with Salesforce, Adobe, Odoo, and Drupal Association.

Focus Area

Company Continue to invest heavily in building top-class teams via lateral hires in key focus areas of Data Sciences/Big Data/Al & ML as well as Onshore presence of Sales and Client Management teams.

Revenue Split FY23

Segment Wise Breakup

Services: 97%

Products & Customization: 3%

Technology Wise Breakup

Mobile & Open-Source Technologies - 10%

Artificial Intelligence - 11%

Salesforce - 32%

QA & Automation - 4%

Big Data - 13%

Odoo- 14%

Dev Ops- 13%

Geographical Split

India: 23%

Europe: 7%

North America: 66%

Rest of the World: 4%

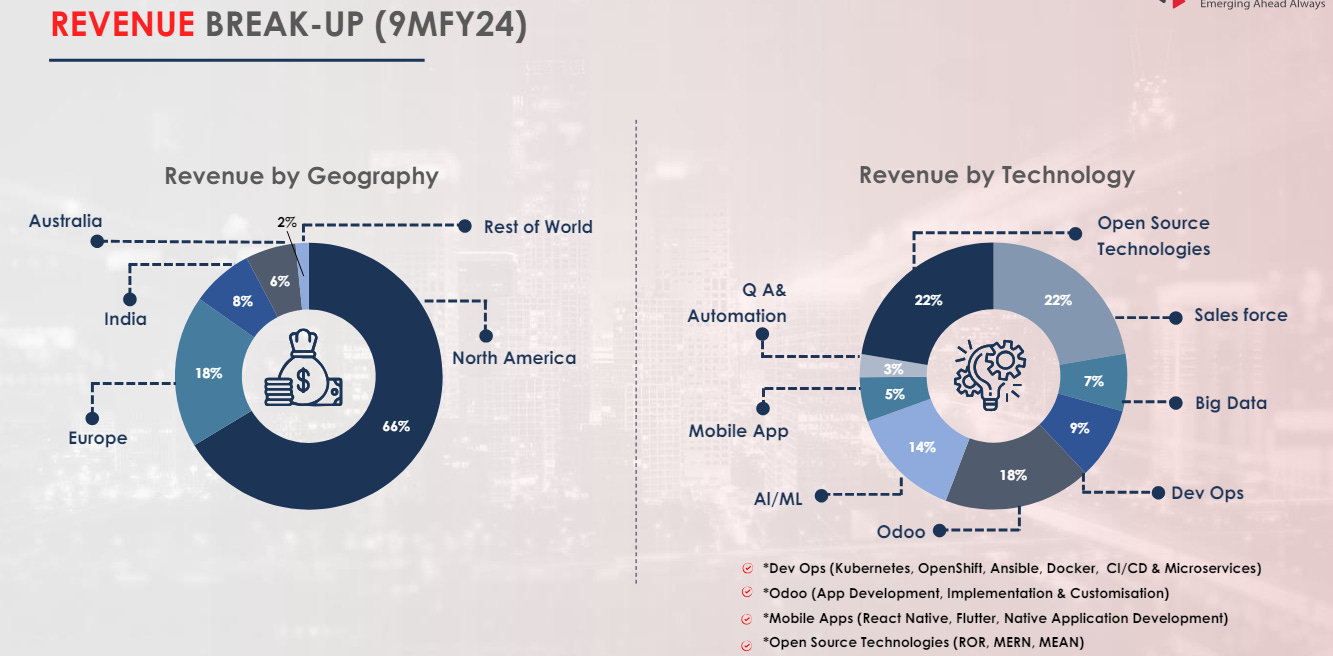

Revenue Split (9MFY24)

Segment Wise Breakup

Services: 97%

Products & Customization: 3%

Technology Wise Breakup

IT & Services - 49%

E-Governance - 4%

BFSI - 7%

Marketing & Advertising Telecom - 8%

Heathcare - 1%

Telecom - 9%

Edu Tech - 7%

Retail - 9%

Manufacturing - 4%

Others - 3%

Geographical Split

Australia - 6%

India - 8%

Europe - 18%

North America - 66%

Rest of World - 2%

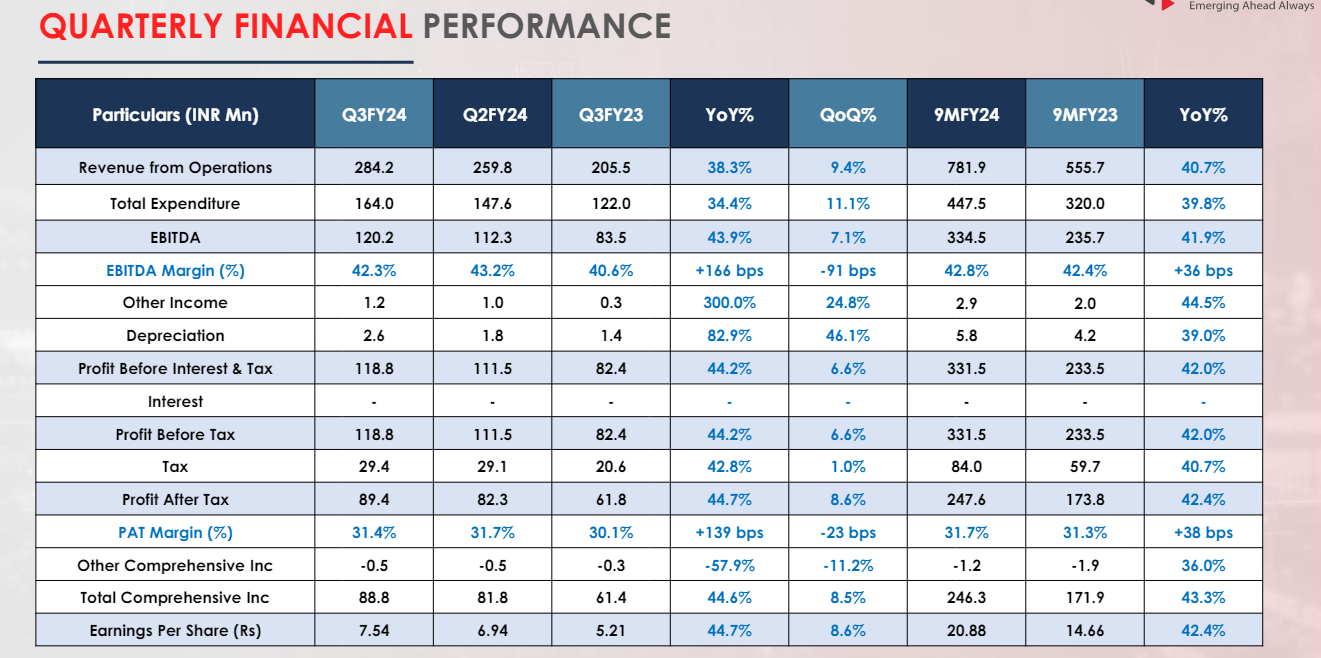

QUARTERLY FINANCIAL PERFORMANCE

QUARTERLY PERFORMANCE – Q3’FY24

ANNUAL INCOME STATEMENT (CONSOLIDATED)

Financials

|| Market Cap ₹ 1,354 Cr. || Stock P/E 42.5 || Book Value ₹ 24.3 || Dividend Yield 2.06 % || ROCE 171 % || ROE 128 % || Profit growth 44.5 % || Promoter holding 58.9 % || Return on assets 86.9 % || Enterprise Value ₹ 1,344 Cr. || EVEBITDA 31.2 || Debt to equity 0.00 || Debt ₹ 0.00 Cr. || CFO/EBITDA 62% ||

PROS

Company is almost debt free.

Company is expected to give good quarter

Over last 5 years company has delivered good profit growth of 234% CAGR

Company has a good return on equity (ROE) track record: 3 Years ROE 120%

Company has been maintaining a healthy dividend payout of 57.0%

CONS

Promoter holding has decreased over last 3 years: -9.08%