IZMO Ltd

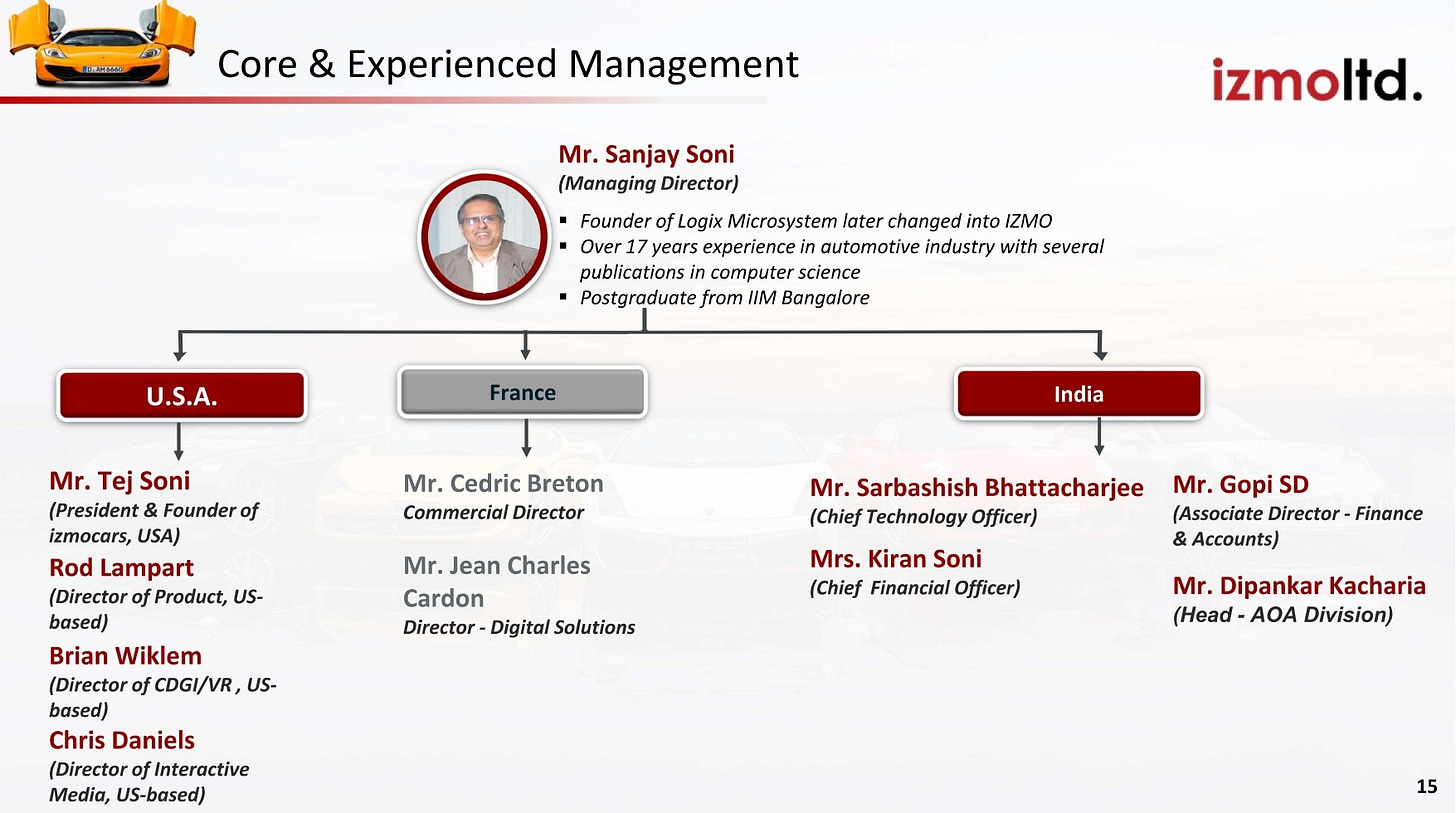

Izmo is a leading company in the automotive retail industry, known for creating cutting-edge products that set benchmarks in the market.

Izmo ltd. Is into the business of interactive marketing solutions. The company offers hi-tech automotive e-retailing solutions in North America, Europe, and Asia. The company, founded in 1995, is listed on the BSE and NSE.

Izmo is a leading company in the automotive retail industry, known for creating cutting-edge products that set benchmarks in the market. Over the years, they have developed a reputation for being pioneers in this space. Some of their notable innovations include:

izmoToolkit (2002): One of their early products that set a foundation for their future innovations. It likely offered tools that helped automotive retailers manage their operations more efficiently.

izmoweb Platform: A comprehensive platform that provides automotive retailers with fully functional, interactive online stores. This platform enables dealerships to showcase their inventory online, offer detailed car animations and graphics, and provide a rich customer experience.

Business Software Market

Global business software & services market was valued at $389.86 billion in 2020 and forecasted to grow at CAGR of 11.3% during 2021-28

Growing automation of business processes and increase in enterprise data are driving growth in this industry

COVID-19 pandemic further expedited this growth as demand for SaaS based services and products increase across sectors

E-Marketing Industry

Global digital marketing sector, valued at ~ $321 billion in 2022, reached $366.1 billion in 2023, growing 14%; and is forecast to reach $671.8 billion by 2028

Rising investments in online video and mobile advertising have fueled overall digital marketing expenditure in North America and Western Europe

Mobile ad expenditure contributes to ~ 39- 42% of digital spend in Western European markets such as the UK, Germany, and Spain, and expected to grow to 55-60%

Automotive Dealer Market

Market Opportunity

Base Platform Billing Per Dealer: $1,500 – $2,000/month

Add Consulting: $500/month

Add Derivative Products: $1,000/month

Total: $3,500/month

Market Size: $840 million

Services Offered

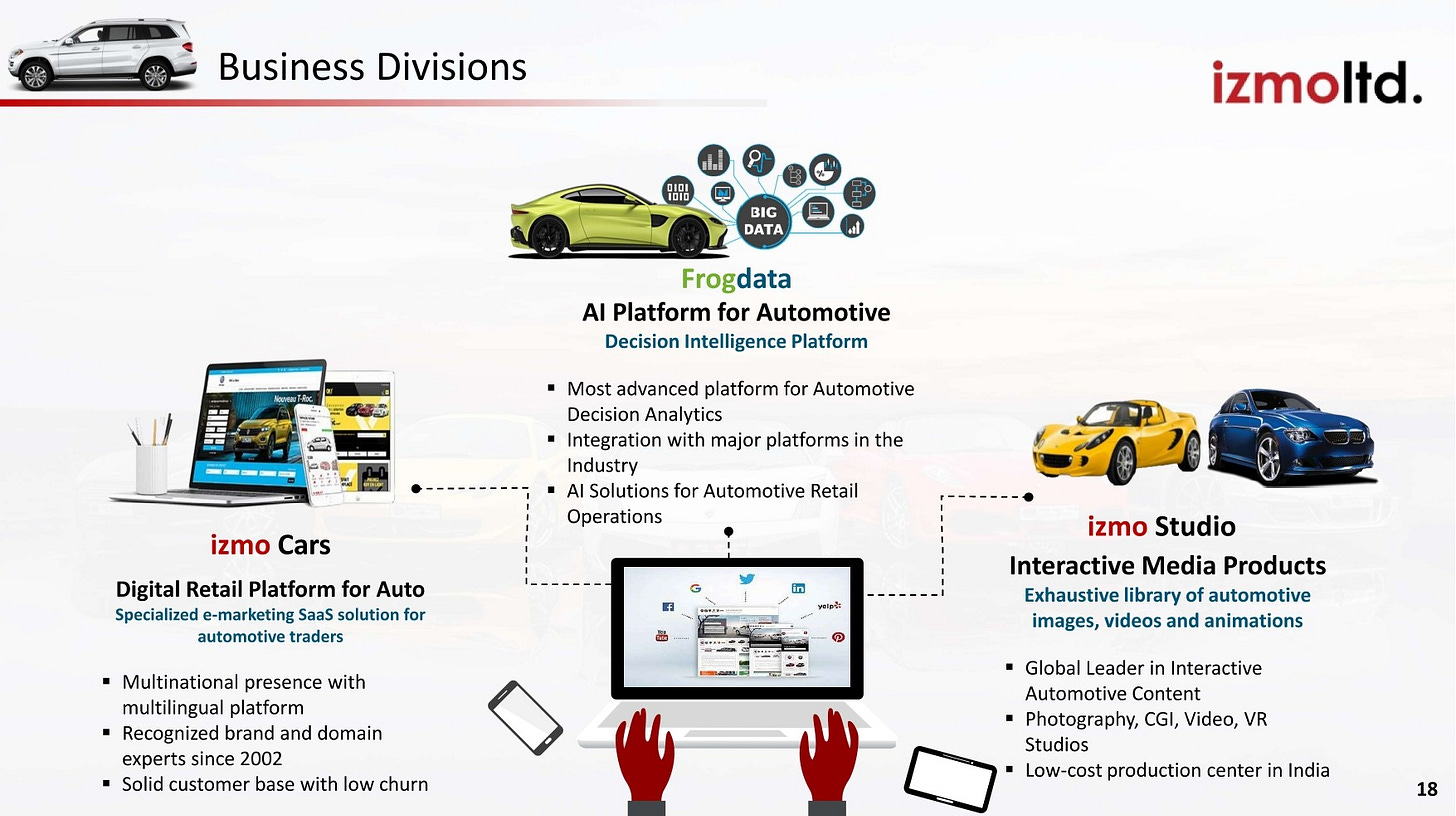

Business Mix

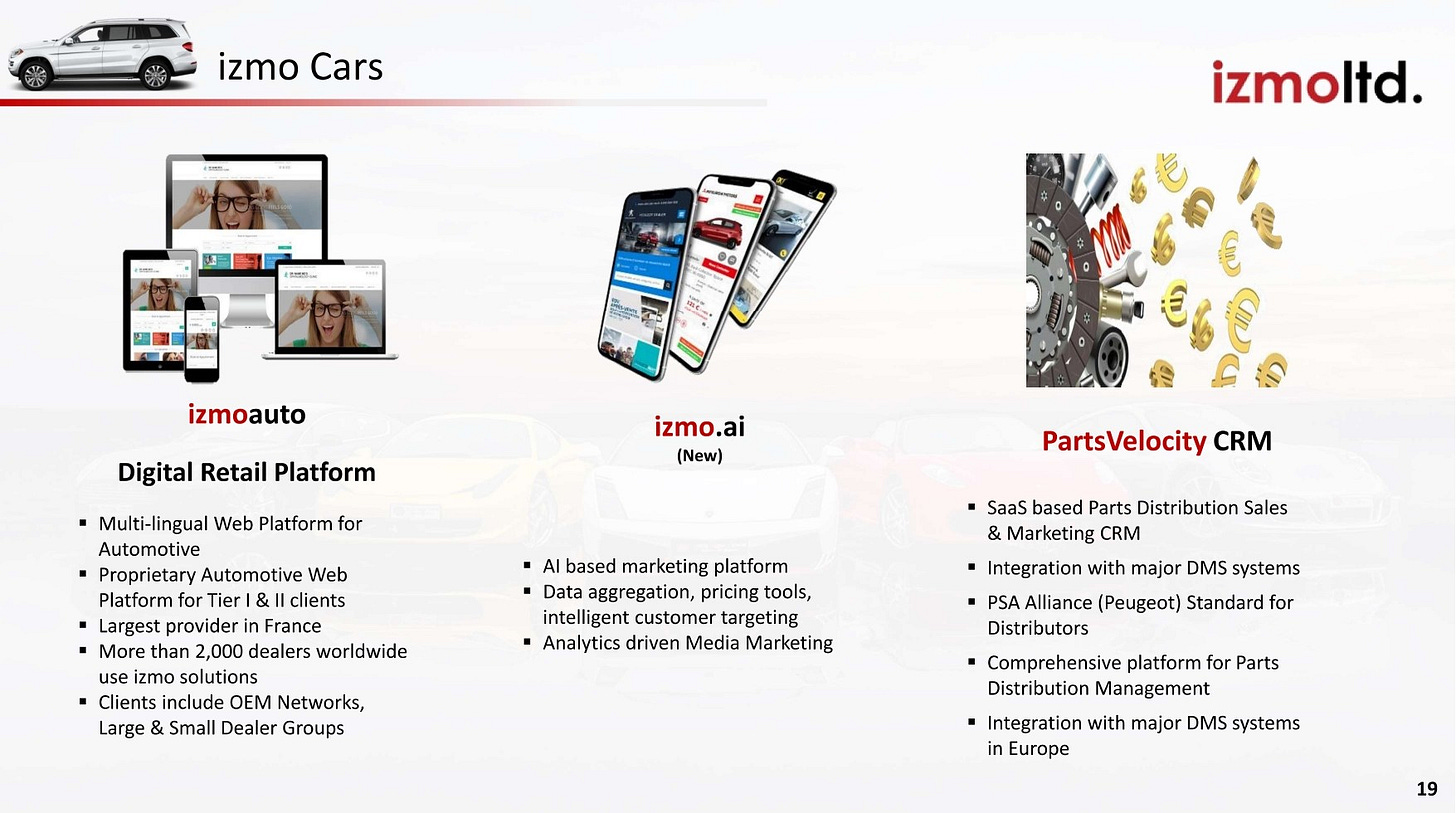

Automotive Solutions – Enterprise Platform for Digital Retail, CRM for After Sales Automotive, Performance Consulting for Automotive Retail excellent

Interactive Media Solutions – Offers world’s largest library of automotive images and animation, 3D Virtual Showroom, Virtual Reality & Video Platform.

AI Platform (New) – . izmo.ai platform for Nexgen customer engagement & intelligent marketing.

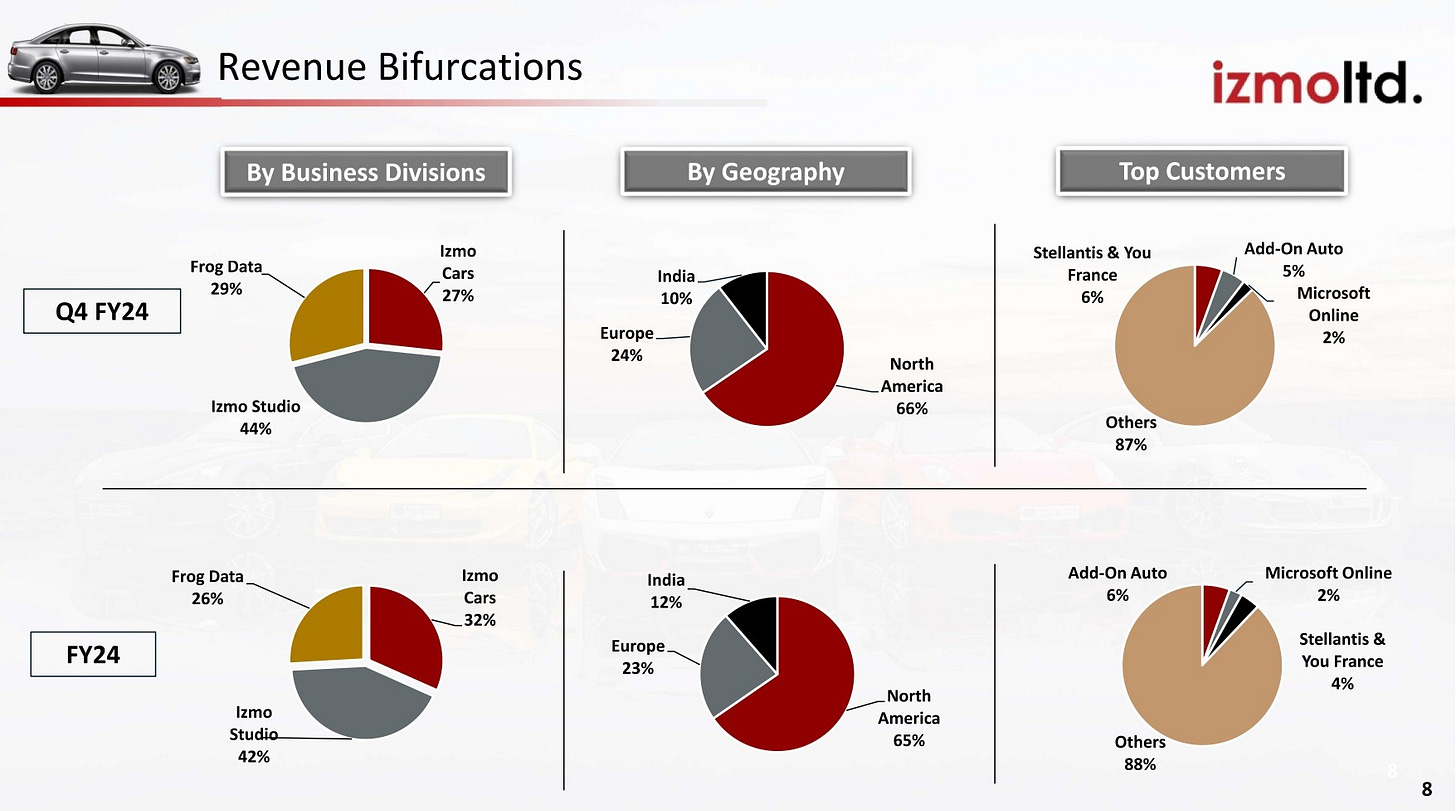

Revenue Mix FY23

Interactive Media Licensing: 47%

Professional: 13%

Digital Web Services: 21%

CRM: 3%

Data Analytics SaaS: 8%

Recurring Services : 7%

Others: 1%

Geographical Mix FY23

North America: 56%

Europe: 25%

India: 19%

Segment Revenue FY23

Izmo Studio : 47%

Izmo Cars : 32%

Frog Data : 21%

Marquee Clients

Automotive – Stellantis France, Emil Frey, Microsoft, Hertz, Europcar, Renault, SONY, Ford.

Information Technology – Microsoft, Infosys, Wipro, Dataone, Rambus and IBM

Telecommunication – Airtel and Idea

R&D

The R&D (Research and Development) team at Izmo has made some impressive achievements, including:

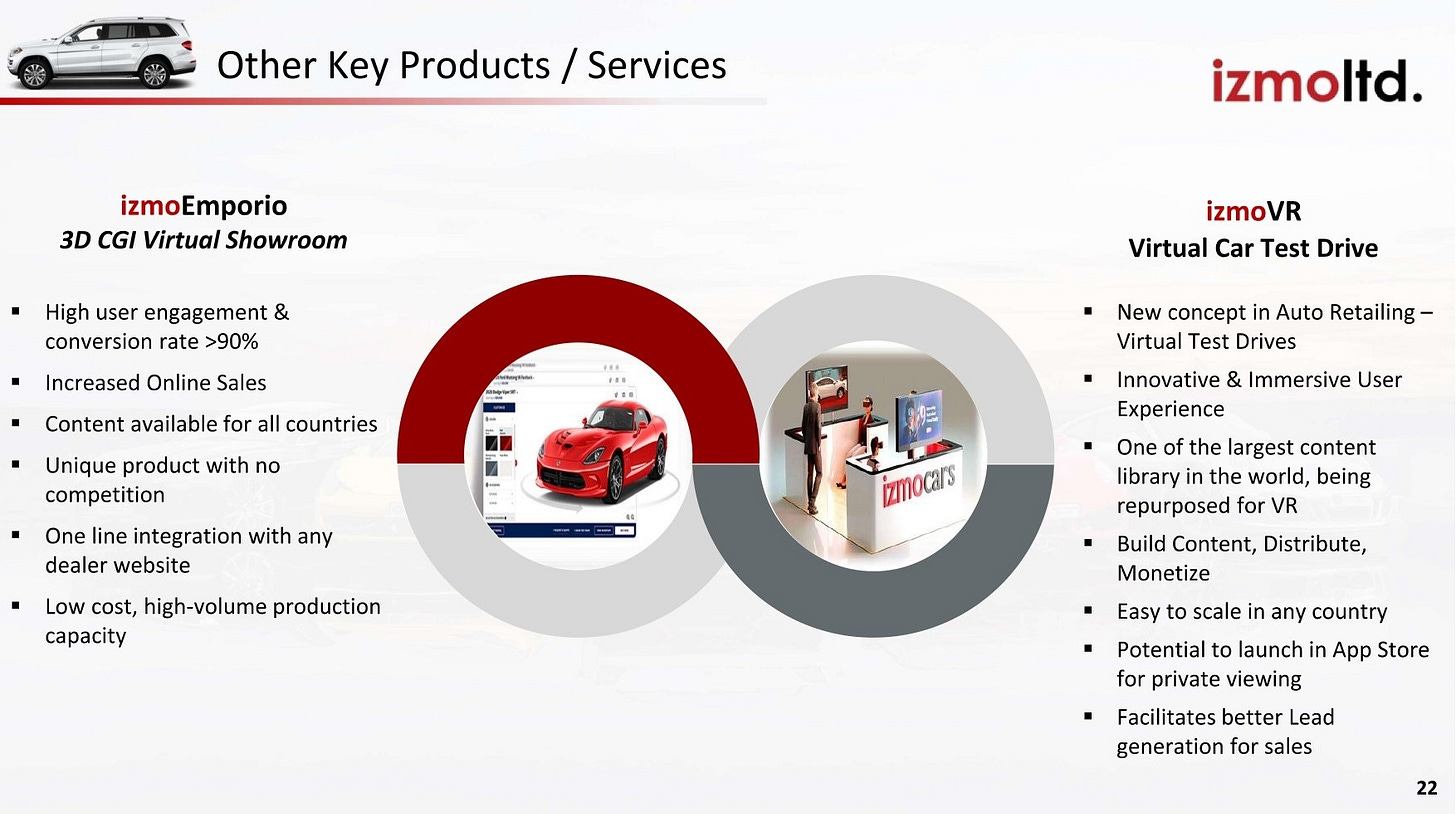

1. Virtual Reality (VR) & Augmented Reality (AR) Platform: They created a first-of-its-kind platform that uses CGI (Computer-Generated Imagery) to bring virtual and augmented reality into car retailing. This means customers can experience cars in a virtual showroom or see how a car would look in their driveway using AR, all from their computer or smartphone.

2. AI Big Data Platform for Decision Making: They developed a powerful platform that uses artificial intelligence (AI) and big data to help make smart decisions

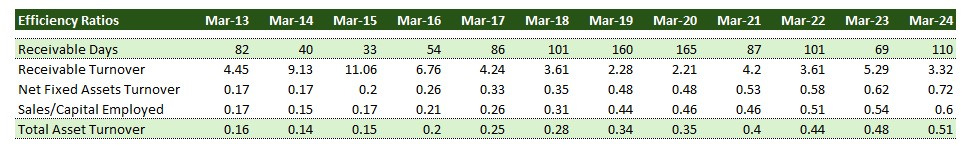

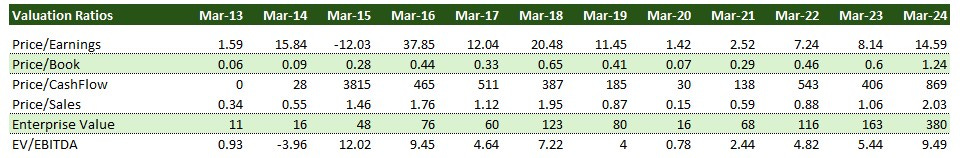

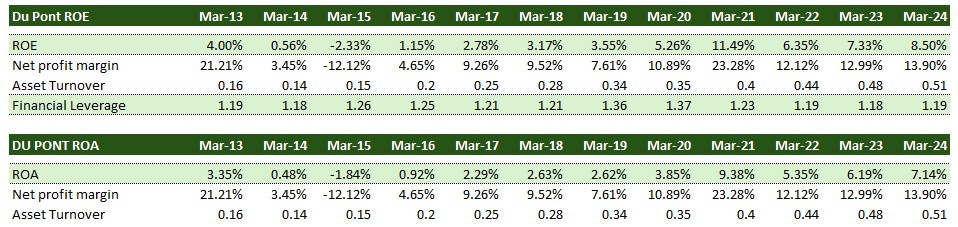

Ratios

Market Cap ₹ 641 Cr.

Current Price ₹ 454

High / Low ₹ 559 / 150

Stock P/E 24.6

Book Value ₹ 217

ROCE 9.35 %

ROE 8.99 %

Profit growth 30.1 %

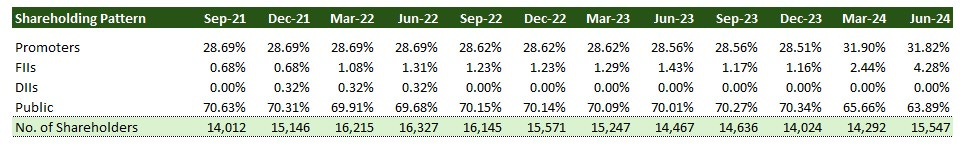

Promoter holding 31.8 %

Return on assets 7.59 %

Enterprise Value ₹ 628 Cr.

EV/EBITDA 14.5

Equity capital ₹ 14.1 Cr.

No. of Share Holders 15,547

No. Eq. Shares 1.41

Debt ₹ 4.41 Cr.

Int Coverage 28.7

CFO/EBITDA 0.77

PEG Ratio 0.79

Exports percentage 99.3 %

Price to Sales 3.43

Current ratio 1.96

ROIC 8.74 %

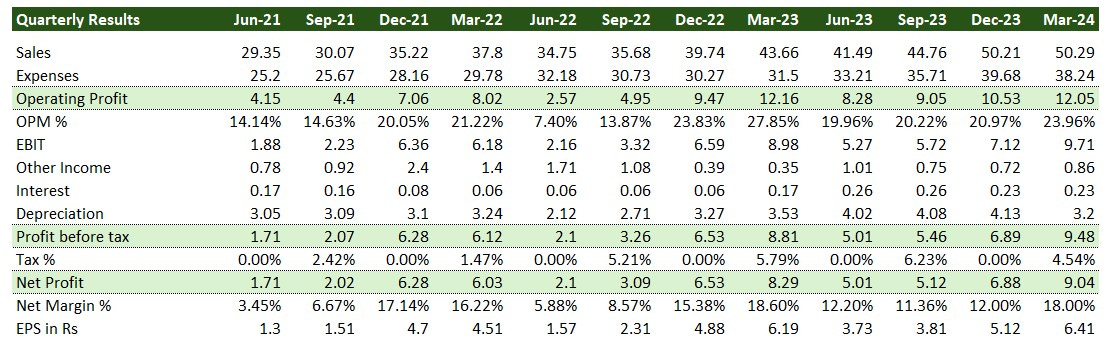

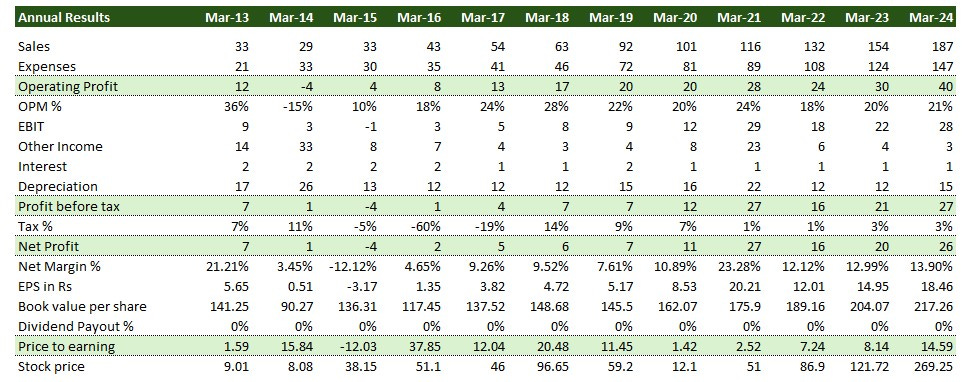

Financials

Management & Core Team Analysis

Pros

Company has reduced debt.

Company is almost debt free.

Company's median sales growth is 16.0% of last 10 years

Cons

Promoter holding is low: 31.8%

Tax rate seems low

Company has a low return on equity of 7.80% over last 3 years.